According to USA Today, there were 765 million data breaches and cyber attacks from April to June of 2018. The high risk of cyber breach means businesses need to understand the threats as well as coverage options available.

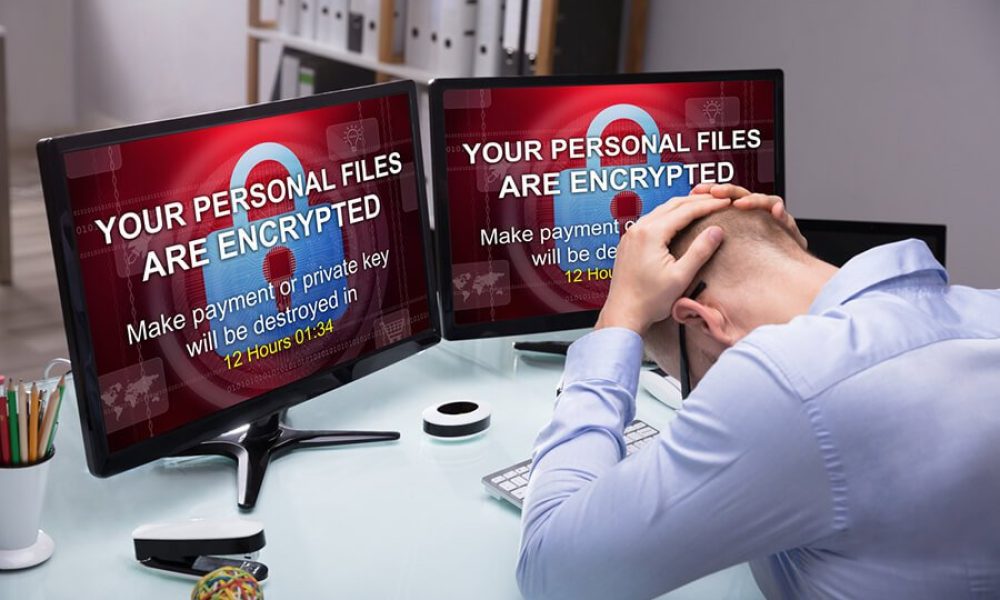

Cyber liability insurance is designed to mitigate expenses if your company has a data-breach loss. This could be something as small as a single customer’s credit card getting into the wrong hands or as big as ransom malware that will delete all your records if the hacker’s demands are not met There are many types of cyber insurance. For example, cyber risk insurance has first-party coverage that includes:

- Loss of, or damage to, your electronic data, including harm caused by theft and disruption

- Loss of income

- Extra expenses needed to minimize the amount of time your business is shut down due to a breach

- Financial losses due to cyber extortion, such as ransomware and payment demands

- Notification costs to alert individuals impacted by the breach, as required by state statutes.

There are also options for third-party coverages that can provide protection if your business is sued for causing network privacy violations or damage to others’ systems. Which cyber coverages you choose depends on your use of data and vulnerability to intrusion. Let us help you find the options best for you.